The Rise of Automated Forex Trading Software

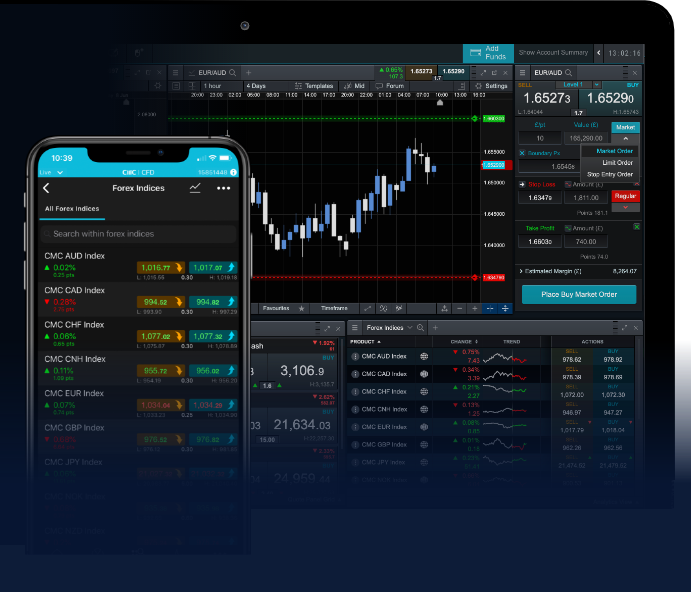

As the foreign exchange market becomes increasingly sophisticated, traders are turning to advanced technologies to gain an edge in this competitive environment. One of the most significant developments in this field is the rise of automated forex trading software Trader Marocco. This technology allows traders to execute transactions based on pre-defined algorithms, effectively enabling them to trade 24/7 without the need for constant human intervention.

Understanding Automated Forex Trading Software

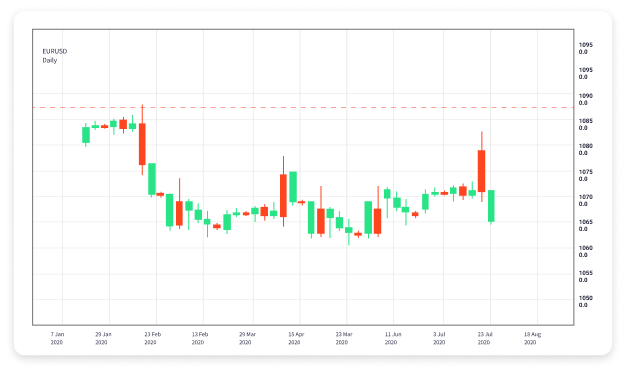

Automated forex trading software, also known as trading robots or Expert Advisors (EAs), utilizes algorithms to analyze the forex market and make trading decisions based on pre-set criteria. These software programs can assess vast amounts of data in seconds, identifying trends, patterns, and trading opportunities that may not be apparent to human traders.

How Does Automated Forex Trading Work?

At its core, automated trading software uses technical analysis, which involves analyzing historical price movements and other market data to make predictions about future trends. Traders configure their software with specific parameters, such as:

- Trade size

- Entry and exit points

- Stop-loss and take-profit levels

Once the software is configured, it scans the markets for opportunities that match the set criteria. When a trading signal is generated, the software can automatically execute trades on behalf of the trader, often in a matter of milliseconds.

The Benefits of Using Automated Forex Trading Software

Automated forex trading software offers numerous advantages, making it an attractive option for both novice and experienced traders:

1. Eliminates Emotional Trading

One of the most significant pitfalls in forex trading is the emotional aspect. Fear and greed can lead to impulsive decisions, resulting in substantial losses. Automated trading eliminates this problem by following a set strategy without the influence of emotions.

2. Increased Speed and Efficiency

Automated systems can analyze market data and execute trades much faster than a human could. This speed is essential in the forex market, where even a tiny delay can result in missed opportunities or losses.

3. 24/7 Trading

Unlike traditional trading methods that require constant monitoring of the markets, automated trading software can operate around the clock. This capability enables traders to take advantage of global market opportunities in real-time, regardless of their local time zone.

4. Backtesting Capabilities

Automated trading software allows traders to backtest their strategies using historical price data. This feature can help determine the viability of a trading strategy before applying it to live markets, providing valuable insights into its potential performance.

Challenges and Risks of Automated Forex Trading

While automation offers numerous benefits, it is not without its challenges and risks:

1. Dependence on Technology

Automated trading relies heavily on technology. Failures in hardware or software can lead to significant losses. Traders must ensure that they have reliable systems in place and conduct regular maintenance checks.

2. Market Conditions

Automated trading systems may struggle in volatile or rapidly changing market conditions. Since they rely on past data, they may not always adapt effectively to new market dynamics, resulting in unexpected losses.

3. Over-optimization

Many traders fall into the trap of over-optimizing their strategies during backtesting, leading to what is known as curve fitting. While a strategy may appear to work well with historical data, it may perform poorly in live trading conditions.

Tips for Successful Automated Forex Trading

To make the most of automated forex trading software, consider the following tips:

1. Start with a Demo Account

Before deploying a trading bot in live markets, practice using a demo account. This allows you to test your strategy and familiarize yourself with the software without risking real capital.

2. Stay Informed about Market Conditions

While automated trading systems operate independently, traders should remain aware of significant market events that could impact their strategy. Economic news releases, geopolitical events, and other external factors can shape market conditions.

3. Regularly Monitor and Adjust Your Strategy

Even with automated trading, it’s essential to regularly review your performance and make adjustments as necessary. Markets evolve, and trading strategies may need to be updated to stay relevant.

4. Diversify Your Portfolio

To mitigate risk, consider using multiple automated trading strategies or trading different currency pairs. Diversification can help balance potential losses in one area with gains in another.

Conclusion

The emergence of automated forex trading software has transformed how traders operate in the financial markets. By leveraging technology, traders can enhance their efficiency, eliminate emotional decision-making, and capitalize on opportunities around the clock. Nevertheless, it is crucial to remain vigilant and continually adapt strategies to thrive in the dynamic world of forex trading.