In the competitive world of currency trading, the right forex trading software https://exbroker-argentina.com/ can make a significant difference. As traders seek the best ways to analyze the market and execute trades efficiently, the demand for powerful software platforms has steadily grown. Understanding the top features and options available can help both novice and seasoned traders make informed choices about their trading tools.

Understanding Forex Trading Software

Forex trading software is a program that enables traders to analyze the currency market and execute trades. These platforms come equipped with various tools that allow traders to conduct technical analysis, set up trading strategies, and automate their trading processes. When choosing software, it’s essential to consider several factors such as user interface, functionality, stability, and customer support.

Types of Forex Trading Software

Forex trading software can generally be categorized into three types:

- Desktop Platforms: These are applications that traders download and install on their computers. They tend to offer a comprehensive set of features and tools, allowing for serious trading.

- Web-based Platforms: These platforms can be accessed through a web browser and do not require any downloads. They offer flexibility and convenience, making it easier to trade on the go.

- Mobile Apps: Increasingly, traders are using mobile applications to trade on their smartphones. These apps provide essential tools and features that allow users to manage their accounts and execute trades wherever they are.

Top Forex Trading Software Features

When evaluating Forex trading software, traders should look for features that enhance their trading experience. Some of the most important features to consider include:

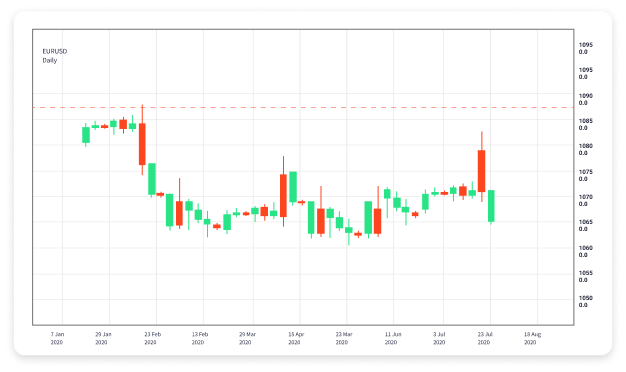

- Charting Tools: Advanced charting tools with multiple indicators and overlays are vital for technical analysis.

- Automated Trading: Many platforms offer capabilities for algorithmic trading, allowing traders to set parameters and let the software execute trades automatically.

- Risk Management Tools: Effective software should include features to help traders manage risks, such as stop-loss orders and position sizing calculators.

- Multiple Order Types: A variety of order types (market, limit, stop loss, etc.) helps traders implement more complex trading strategies.

- Customization: The ability to customize the user interface, chart layouts, and trading alerts can significantly enhance the trading experience.

- Integration with Third-Party Tools: Good forex software should allow integration with various tools, including news feeds and economic calendars.

Popular Forex Trading Software Options

There are numerous Forex trading software options available, each with its unique features and benefits. Here are a few popular choices:

- MetaTrader 4 (MT4): Perhaps the most famous Forex trading platform, MT4 is favored for its user-friendly interface, extensive charting tools, and robust automated trading capabilities.

- MetaTrader 5 (MT5): An upgraded version of MT4, MT5 includes additional analytical tools, more order types, and a wider range of financial instruments.

- NinjaTrader: This platform is known for its extensive charting and analytics features, making it ideal for serious traders looking to develop advanced trading strategies.

- cTrader: cTrader offers a sleek interface and excellent execution speeds, focusing on fast and efficient trading.

- Sierra Chart: A highly customizable platform, Sierra Chart is known for its extensive charting capabilities and advanced order handling.

How to Choose the Right Forex Trading Software

Choosing the right Forex trading software depends on several factors, including your trading style, experience level, and specific needs. Here are some tips to make the selection process easier:

- Determine Your Trading Style: Consider whether you are a day trader, swing trader, or long-term investor, as different platforms cater to different approaches.

- Test Demo Accounts: Many software providers offer free demo accounts. Use this opportunity to test the tools, features, and overall user experience.

- Read Reviews: Look for reviews from other traders and independent sources to gauge the reputation and performance of the software.

- Consider Costs: Evaluate the costs associated with trading software, including commissions, spreads, and any subscription fees.

- Customer Support: Ensure the software provider offers reliable customer support to help you troubleshoot any issues that may arise.

The Future of Forex Trading Software

The future of Forex trading software is evolving rapidly. Technological advances, such as artificial intelligence (AI) and machine learning, are being integrated into trading platforms, enhancing traders’ ability to make informed decisions. Moreover, the growing popularity of social trading and copy trading is influencing software development, allowing traders to follow and replicate the strategies of successful traders.

Conclusion

In conclusion, choosing the right Forex trading software can significantly impact your trading success. With a wide variety of platforms available, careful evaluation based on your trading style and requirements is crucial. By taking advantage of the tools and features offered by top software providers, traders can enhance their trading experience and increase their potential for profits. As the market continues to evolve, staying informed about updates in trading software will be essential for long-term success in the Forex market.